What is Degenerate Finance?

The central hub for trading high risk, high reward investments, in addition to a safe, sustainable, and revenue backed yield. Sustainability is key in any project, and with various revenue-producing utilities on board for our project, it has been shaped in a way that both longevity and growth is our core goal but not taking the full excitement of DeFi.

What is the project's main goal?

Staking

Native Token Staking

DeFi can be staked to earn high APR over time, yielding native tokens. When you stake, an NFT is minted which holds the principal stake and the yield obtained from the pool. These are the keys to your stake and are needed to unstake your tokens. You are able to freely transfer this NFT and use it on the secondary market, or within our utilities.

Staking Lockup & Yields.

| Lockup (days) | APR (%) |

|---|---|

| None | 12.5% |

| 14 days | 25% |

| 120 days | 50% |

| 240 days | 75% |

| 360 days | 100% |

Liquidity Staking

For the even more degen at heart users, DeFi Liquidity tokens are stakable. You can yield even higher returns by staking your tokens this way. Once staked, an NFT will be minted and sent to the user. This NFT works the same way as the native token staking.

Staking Lockup & Yields.

| Lockup (days) | APR (%) |

|---|---|

| None | 25% |

| 14 days | 37.5% |

| 120 days | 75% |

| 240 days | 112.5% |

| 360 days | 150% |

Gambling Platform

Why gambling?

To complete our vision of becoming the central hub for 'trading' high risk, a gambling platform is the last piece of our puzzle.

Perpetual Future Trading Platform

Futures trading platform - doesn't get anymore degen than that.

To fully incorporate our name onto the project's belief, and bring our mission of becoming the central hub for trading high-risk but sustainable, a perpetual futures trading platform would be just the right fit.

Fees

All fees are charged in the native token. This will be deducted from your collateral upon opening a position and closure.

Opening/closing of the position:

- 0.1% of position size

- 0.005% per hour of position opened

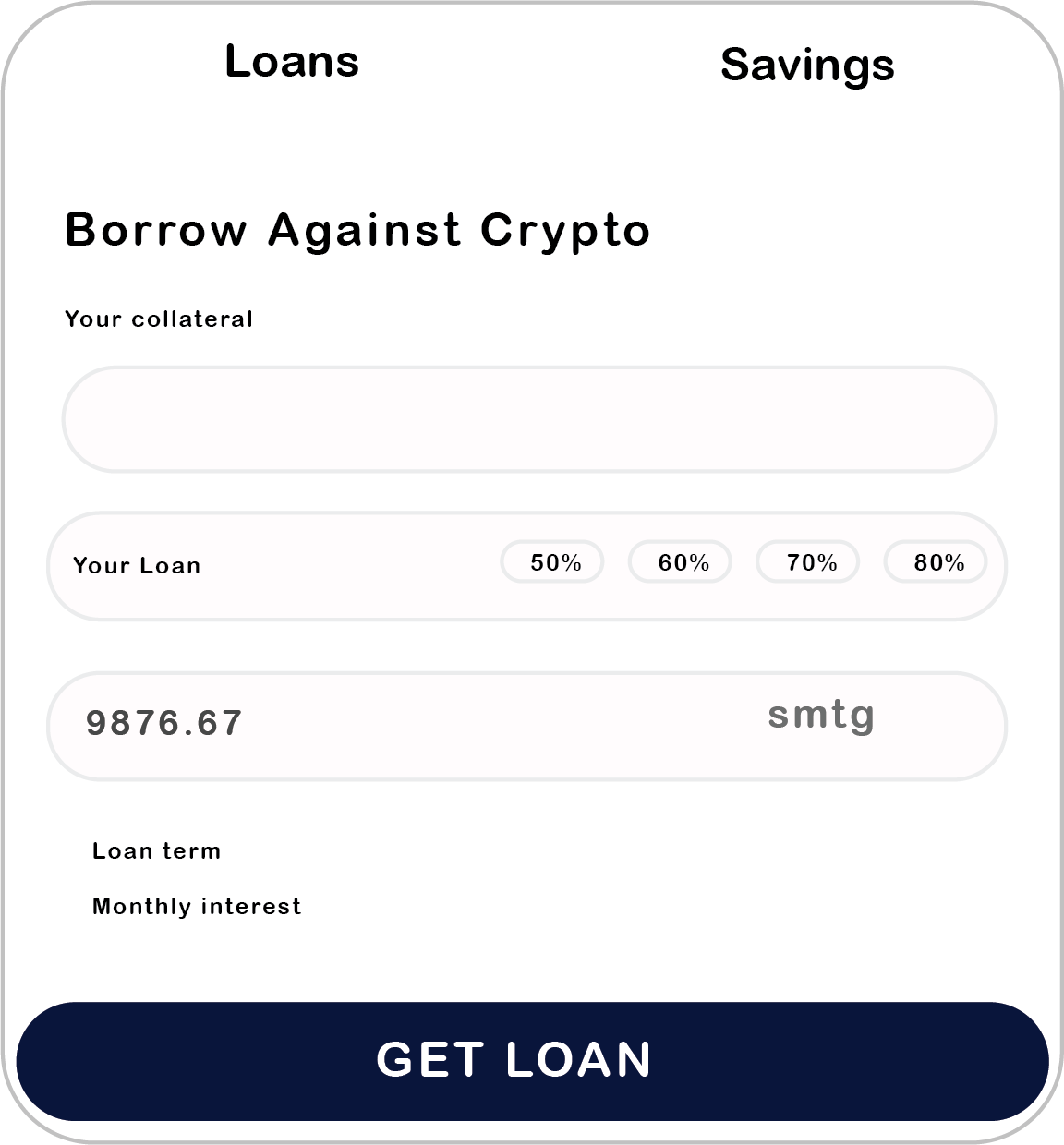

Borrowing & Lending Platform

Within the crypto space, there are a lot of opportunities for people to use their money in various forms, including borrowing or lending based on collateral.

With us, people can stake their DeFi, return an NFT, put that up as collateral and borrow liquid assets against the value.

Tokenomics

Starting Supply: xxxxx

Supply Allocation: xxxxxx

Tax Percentages:

BUY TAX: 5%

SELL TAX: 13%

*Decaying sell tax, eventually turning to 5%.

The usual tax for DeFi is 5/5, but our sell tax will gradually decrease on launch from 13% to 5% over a 4 day period, reduced by 2% a day.

Minting and Burning:

- DeFi is minted when a user unstakes their "" or "" NFTs, which consequentally mints DeFi to their vesting contract.

- DeFi is burned when a user interacts with our platform, which generates fees, burning DeFi.

Roadmap

Q4 2022

Copy Trading pool

Q4 2022/Q1 2023

Gambling Platform

Q4 2022

Perpetual Future Trading Platform

Q1 2023

Borrowing & Lending platform